Vinamilk - 1Q results not that bad, but not so exciting

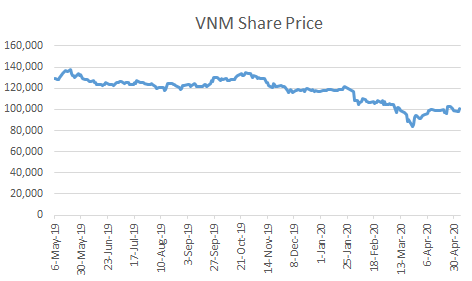

/Source: Vietstock.com.vn

Oh, Vinamilk. The stock has not performed well, which is a bit surprising, given that it is a consumer staple. Growing girls and boys still need milk. Of course, exports are an increasing part of the business, and closed borders definitely don’t help those.

Since Tet, the stock is down 7%, YTD it is down 14% and over the past 12 months it is down 22%. In summary, the stock was already performing poorly, but it performed relatively well during the pandemic. And it has recovered a bit.

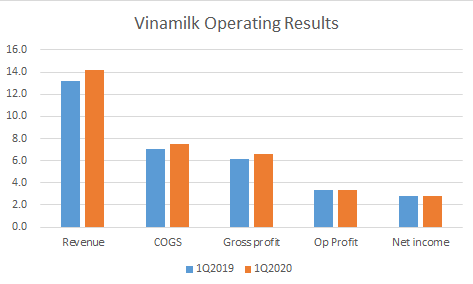

Last week, earnings came out for 1Q, and they were alright, or at least showed stability, which is something very few other stocks can say. Revenues were actually up 7%, as were gross profits. Operating profit rose 1%, but net profit after tax and minority interest was down 1% (due to a reversal in other profit/loss).

Remember that Vinamilk has extremely high returns (see this post). But they are falling. Return on equity was 34.5% (using TTM net income), down 270bps from 1Q2019. Inventories are also up, despite lower COGS (qoq) - although days inventory of about 69 days is mostly unchanged from 1Q2019.

The decline in returns would not be the case if the company actually meets its guidance of VND12.4tr in profit this year, up from VND10.6tr in 2019 and returns equity in the form of dividends. The company is sitting on a lot of cash - almost VND16tr including short-term investments, most of which are deposits at banks.

The stock is trading at 16x forward P/E (almost 18x trailing), which isn’t that expensive, given that the company prints cash. But I would be a bit nervous investing in the company if it continues to make dilutive investments outside of Vietnam.