Revisiting Beyond Meat

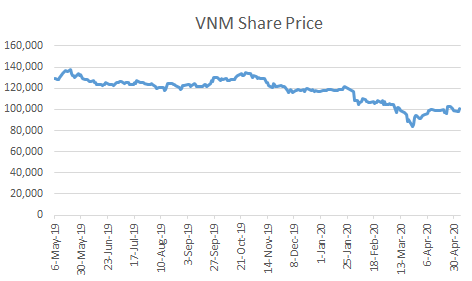

/Source: Yahoo finance, chart by Vietecon.com

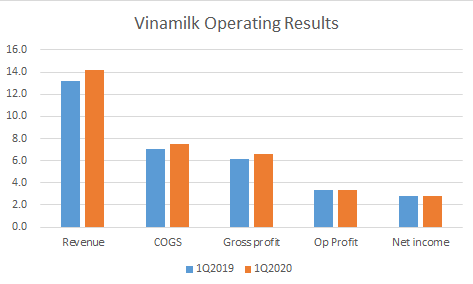

The company reported 1Q results, and they were very good.

A few key items:

Revenues were up 141% yoy (although weirdly -1% qoq).

Gross margin rose again to 39%.

There was a lot of growth in foodservice sales, which means to restaurants. It was up 100%. But of course most of the quarter was over before all of the COVID-19 related closures happened, so we are going to see more of that in 2Q.

Retail sales grew much faster than to foodservice at 185%, both domestically and internationally. International was nothing in 1Q, so this is real progress.

SG&A is high again at 28% of sales and $27m. This was trending down as a percentage of sales, but it’s back up again. Seems fairly normal for this stage of a business/industry - there is a lot of education that needs to happen around Beyond Meat - but I would hope that this declines over time.

There is a real concern over meat production right now with COVID-19. Wendy’s cut beef from 20% of its stores. I could see something like Beyond Meat doing very well out of this.

The company stopped giving guidance, but previous guidance for 2020 was for revenue of $490-510 million and adjusted EBITDA margin of 9.7%, or $48-49 million.

I redid my DCF analysis, and based on what we have seen so far and assuming that things get back to mostly normal next year, we could see growth continue at high levels. Especially because so many more people will have tried the product. Plus, the company hopes to lower prices over time (prizing volumes over gross profit).

Even with a much more positive view of things, I still find it very difficult to get comfortable buying the stock. Remember, it is trading at 73x trailing revenue. That only falls to 55x this year. We don’t get to a reasonable P/E until 2026 when it will be 25x. And that’s with a CAGR of 23% for gross profit from now until 2026 and sales of $1.8bn in that final year.

But maybe that’s not positive enough. $2bn in sales is nothing for a stellar consumer brand. If we assume that prices fall 3% a year from now until then reaching $4.69 per pound (which is similar to ground meat right now), then that is only 385m lbs of beef, 1% of total beef consumption (not counting pork or chicken).

If we increase that CAGR to 25%, then the value starts to look more attractive, which is what I show in the DCF below.

It’s a risky bet, but I think that more and more people are going to be interested in meat alternatives, and COVID-19 may actually help that trend, because, at least in the US, we are learning so much about the horrors of the meat packing plant.

Source: Vietecon.com