Baby's back!

/So, I have been away, enjoying some time off from the blog, but surprisingly busy as well. Hope you haven’t missed me too much. I will be back to the regular daily schedule from now on.

Let’s get right into it. Here is a story that interested me over the past few days:

Retiring in Vietnam: I found this LA Times story extremely interesting from an economic perspective. Quick summary: lots of Americans are looking to retire to Vietnam. Many of these retirees are veterans of the US war with Vietnam, so they are “coming back.”

Added to that is this article about the 10 best places to retire. Vietnam is ranked #10, but what’s interesting is the company Vietnam keeps: France! Spain! Portugal! I feel there is a big difference between people retiring in Vietnam versus those retiring in Europe, with Vietnam being for more adventurous retirees. Although anyone looking to retire in a foreign country is pretty adventurous.

Based on the LA Times article, it appears that the retirees are mainly people (men) that had a very international career. Most of the people quoted had worked and lived abroad a fair amount. Also, many of them lived in Vietnam at one point, and/or married a Vietnamese person (woman).

What could the economic impact be of all these retirees? Well, there are a few:

1) Investment: Lots of retirees would be interested in buying a house, if possible, which would help the property market, especially the high end one. And they might actually invest money in other types of businesses as well.

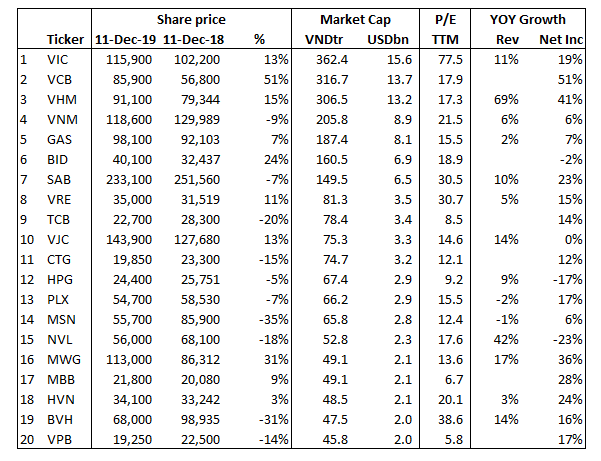

2) Higher consumption than Vietnamese residents: The articles quote living expenses of around $1,500 to $2,000 for a family per month. As a reminder, GDP per capita was around $2,500 per year in 2018 in Vietnam. So they are spending between 6-10x as much as a local. That’s good for the economy.

3) Skills: Both of the two main people quoted in the article continue to work at least part-time. Rockhold is an investor and consultant. Gormalley teaches. Both bring experience and expertise in a region that doesn’t have enough of either.

Unfortunately, we don’t have a sense of how many retirees there are, but let’s take a shot.

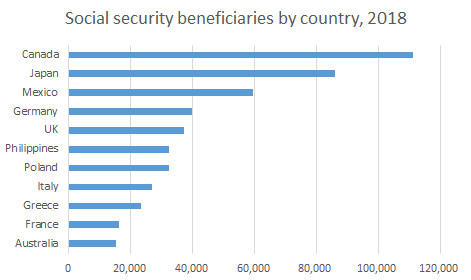

The number of retirees claiming social security benefits by country, 2018. Source: US Social Security Administration

If there are 10,000 retirees spending $1,500 a month, that’s $15m in spending a month or $180m a year. That’s a good-sized market and one worth catering to. Plus, its probably extremely concentrated in HCMC, so a bit easier to service.

I did find some data that was insightful. The US Social Security Administration reported the number of Americans claiming benefits in foreign countries as of December 2018. Vietnam was pretty far down at 531 beneficiaries. But that definitely understates the number.

First, it’s a year old, so the numbers likely increased. It was only 504 in Dec. 2017, so the trend is positive (albeit from an extremely low base). Second, it makes sense for many people to delay their benefits until a later age (67 or beyond) in order to maximize their eventual benefits. So someone could be retired but not claiming benefits. Third, some may still keep their address in the US for some reason.

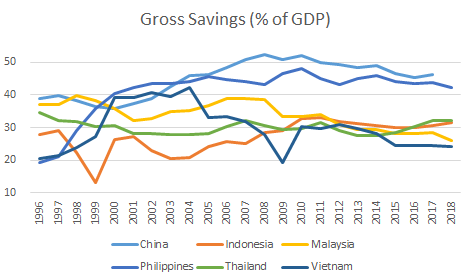

More importantly, the US is not the only source of retirees, there are also Australian or Europeans or Japanese that might want to retire in a cheaper locale. Here’s an article on Australians retiring abroad, for the same reasons as the US: costs.

Thailand had more than 70,000 people applying for a retirement visa in 2017, not all of them Americans. If Vietnam had that many, it would equate to consumption of between $1.26-1.68 billion a year.

The number of retirees in Asia is growing, at least US retirees. Again based on the social security data, there are 6,872 claiming benefits in Thailand. Philippines blows that out of the water at 32,366 beneficiaries, but that’s nothing to Japan at 85,989. All of these numbers increased from 2017 to 2018. Overall, the number of retirees abroad grew about 2%, while those retiring in Asia grew a bit more than 5%.

Interesting point: There aren’t many women quoted in the article. I wonder if women aren’t retiring in Vietnam. That’s something I will have to look into.