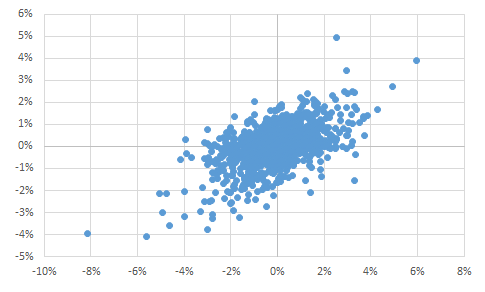

Private equity investments in Emerging markets

/Source: EMPEA

Southeast Asia is one of the most attractive emerging market for private equity (PE) general partners (GPs), according to EMPEA, “the global industry association for private capital in emerging markets.” Specifically, since 2015 (when the data starts) the region has been the most attractive or second most attractive market among GPs.

So it was interesting to see new data from EMPEA on investments in emerging markets. A few key points:

Fundraising by type of fund. Source: EMPEA

Fund managers raised $31.9bn for emerging markets and invested $26.3bn in 1H2019. There are down 10% and 32%, respectively.

$1.4bn was raised by Southeast Asian funds in 1H 2019. This is a rebound from the lows of 2016.

Venture capital is in the vanguard, with “nine VC or venture debt funds achieved a close in the first half of 2019, led by the USD175 million first close of Jungle Ventures’ fourth fund.”

In contrast with the fundraising, actual investment fell to its lowest level in 4 years.

There are few funds actively pursuing buyouts, especially in the mid-market, according to the report.

Hot sectors were: oil & gas, fintech and healthcare. These are for all emerging markets, not ASEAN specifically.

Southeast Asia Venture Capital Investment by Stage, 2016-1H 2019. Source: EMPEA

This seems to rhyme with my experience. We have seen a fair amount of venture investing, but not as much of private equity firms buying out companies that are poorly managed, etc. I guess there is some of that in the public markets (we saw that with Minh Phu, VinGroup), but that’s not private investment.

But looking around globally, Southeast Asia and Africa are the only ones that seem attractive given population growth plus economic growth. LatAm is not looking great, MENA ditto, Eastern Europe being weighed down by problems in Europe, China with the trade war, etc. So ASEAN is actually sitting pretty, but that may not last…

Funny thing: MENA (my old region) showed record investment with $1.1bn deployed. But of course, it was all lead by a $1bn acquisition of a 40% stake in ADNOC Oil pipelines. So really, outside of that, it was a horrible 6 months.