Trade and Beyond Meat

/Just wanted to follow up on a few things:

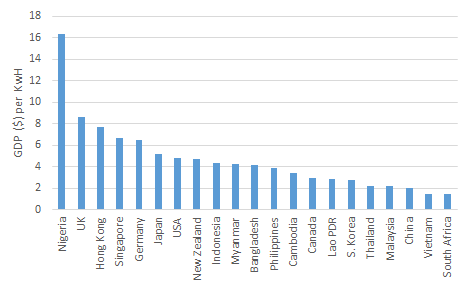

GOODS TRADE SURPLUS (THIS REPRESENTS A DEFICIT FOR THE US), 2018. SOURCE: US CENSUS BUREAU BY WAY OF BLOOMBERG

First, US pressure on Vietnam is increasing, with the US Trade Representative, Robert Lighthizer, telling US lawmakers that “US businesses face a host of unfair trade barriers in Vietnam.” Through May the US had a trade deficit of more than $15bn with Vietnam. That’s a third of the total trade deficit with ASEAN. It’s the US’s sixth largest deficit in the world, similar to 2018 (see chart to the right). One of the problems, mentioned in the Politico story linked to above, is that the US has not been able to negotiate a trade deal with Vietnam, but Europe and the members of TPP have had trade deals implemented. That has allowed them to increase their exports to Vietnam, crowding out American goods. At the same time, more countries are moving production to Vietnam, mainly to export to the US, given the tariffs on Chinese goods and a few other products.

Second, just a quick update on Beyond Meat, which I wrote about on May 3, 2019 (scroll down to see that post).

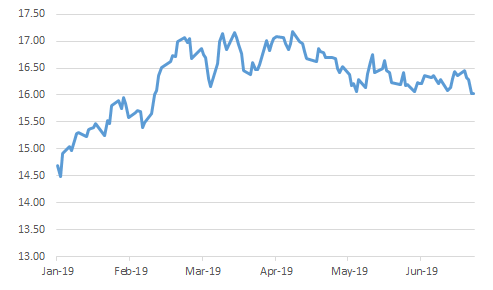

The stock is way up since the IPO, almost 700%. That’s a great return. I should have bought some rather than pooh-poohing it. But I still think my analysis was correct.

The stock is way down: 17% from its high on July 26 and 12% today.

Results (announced yesterday) were good, and they have raised their guidance for revenue in 2019 to $240m, that’s way better than I had forecast and up $30m from new guidance in 1Q. They now look for adjusted EBITDA profit (which excludes a fair amount of stock expenses and some restructuring costs), compared to just break even. So it is very likely that they will get to profitability faster than I expected.

But the stock is down, because investors are selling stock. About 3.25m, compared to the initial IPO, where just 10m shares were sold. Of the new share sales, 250,000 are from the company directly. If it gets $200 per share, that would be $50m in additional cash for the company. I bet it will come in below that but still a good amount.

It already has $277m in cash, but spent about $33m in 1H2019. Since sales are increasing so quickly, we should expect working capital and capital expenses to be high, so the cash burn will likely continue for the next year or two at least.

One of the biggest cash expenses is Accounts Receivable, which grew to $34m at the end of 2Q2019. That’s a DSO of 76 days, up from 52 days at 2018 and 40 days at 2017. This means that it takes two and a half months for Beyond Meat to get paid for its sales. Tyson Food’s DSO is just 16.5 days.

This is partially offset by an improvement in Inventory Days, which were 93 days at the end of 2Q, compared to 157 days at 2018 but up from 85 from 2017. While the figure in 2Q is an improvement, it is still crazy high, especially for a perishable item. For comparison, Tyson Food has a DSO of 38 days, which still seems high but maybe it has something to do with the chickens being counted as inventory. That could be the issue with Beyond as well, they have to count the raw materials that stay at the factory longer.

So if DSOs and Inventory days fall, we should see some real improvement in the cash burn, and that seems like it will be pretty easy. That plus the cash balance they have now means that Beyond should be very well placed to grow, develop new products and get their name out there.

But I would still be wary about buying the stock, because it is super expensive. It is trading at 200x 2019 sales! SALES!!! ! That’s even with the updated revenue figure. This multiple falls pretty quickly, but unless they have a revenue CAGR of more than 60% through 2024 and/or have an operating margin of above 20%, I don’t see them trading below 50x P/E or 23x Price/Sales. That’s crazy high. Remember, this is a vegetable burger with implied sales of $1.5bn.

Right now the stock is in the dog house because of this extraordinary (in the sense of out of the ordinary) follow-on share sale so soon after the IPO. Once that is over, and if they beat estimates in 3Q, I bet we will see the stock start to perform well again.

Remember, I am not saying that the company is in trouble. The company is doing great, and the additional share sale is probably fairly smart. All’s I’m saying is that the stock is too expensive, and it is not worth getting ahead of the share sale.