The First Half is Over!

/VNM ETF. SOURCE: YAHOO FINANCE

The first half of 2019 is over. That means that the good half of the year is just starting. Now, why do I say that? First of all, Christmas. Second of all, most vacation is in the second half of the year (including much of the month of August for me, I am turning European, I guess). Third of all, summer is upon us, which is nice. Then fall, which is beautiful. Then winter, of which we just get a bit of before it all turns into sludge and sleet in February.

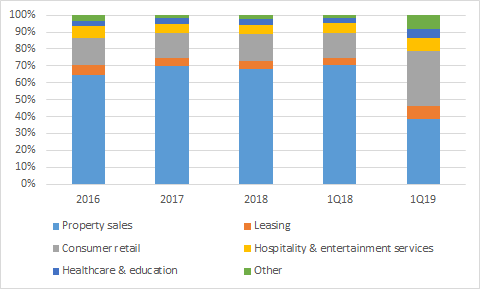

SOURCE: VAN ECK, VIETECON.COM

I want to take some time to look at the stock market in Vietnam, given that the country has been on a roller coaster (as described a few days ago). Generally, things are positive for Vietnam, and it shows in the stock market, which is up 8.8%. Although, this is not that much higher than normal GDP. At one point (April 14, to be exact), the market was up 14.2%.

VNM ETF COMPONENTS BY 1H2019 RETURN AND WEIGHTING. WEIGHTINGS ARE FOR THE BEGINNING OF THE PERIOD EXCEPT FOR THOSE WITH A * WHICH ARE END OF PERIOD. SOURCE: VAN ECK, VIETECON.COM

For foreigners, the Vietnamese market is not easy to invest in. To get a basket of stocks is hard given some liquidity constraints of the index constituents (foreign ownership limits), and there are some other issues surrounding investing in Vietnam. Because of that, many foreigners, especially those that just want general exposure to it, can invest in an ETF, the VanEck Vectors Vietnam ETF. It has assets of around $444m, and trades on average almost $6m. That’s a low value traded but is still double what the largest stock, Vingroup, trades daily on average.

So looking at the ETF, I learned a lot of interesting things.

The index actually has a lot of foreign (non-Vietnamese traded) companies. Mostly Korean. These make up 16% of the weighting. There are also companies from Taiwan and Japan (one company each) that represent about 9% weighting combined. Then there’s a London-listed stock (3.15% weighting) and a Hong Kong-listed one (1.69%). And some USD cash (0.4%).

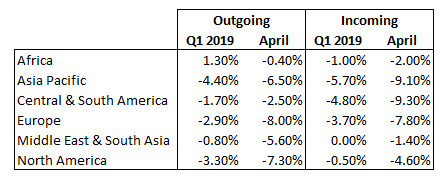

Because of that, currency depreciation/appreciation matters. I mean, it will almost always be the case because the ETF is traded in USD. Usually when you think of a country ETF, you might assume you have to worry about just that country’s currency. Turns out, VNM actually has 5 additional currencies to look at. The Korean Won is the most important. Unfortunately, it fell by almost 4% in the first half, hurting the performance of the fund.

There have been two main additions/changes in the past six months. First, PetroVietnam Fertilizer (DPM) has been replaced by Petrovietnam Power (POW!). POW is more than 5 and a half times larger than DPM, so that’s probably why that swap happened. PetroVietnam has major stakes in both.

The second change is to add Uti Inc from Korea (179900 KS). This one may be a little strange. The company makes glass for touch screens and cameras, an area that is growing. Lots of the company’s production is in Vietnam, although I doubt much of their sales are. I can’t tell when it was added to the ETF, but it is up 235% this year.

Another Korean company, MCNEX, was up 122%. They also make camera components. It looks like both of these are benefiting from Samsung purchasing more components. MCNEX is expending its operations in Vietnam to service Samsung.

I have more insights that I want to get through, but I am running out of time today, so I will follow up this tomorrow.